prince william county real estate tax payments

When prompted enter Jurisdiction Code 1036 for Prince William County. Proceso de pago en espanol.

Prince William County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Press 1 for Personal Property Tax.

. A convenience fee is added to payments by credit or debit card. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. Teléfono 1-800-487-4567 entrando código 1036.

By creating an account you will have access to balance and account information notifications etc. Prince William County collects on average 09 of a propertys. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

Contact the Real Estate Assessments Office Available M. Enter the Tax Account numbers listed on the billing. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes.

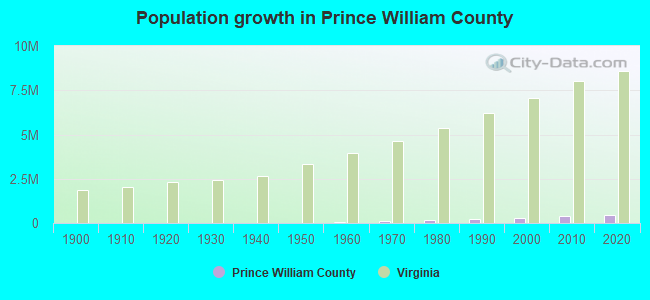

Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Median Property Taxes Mortgage 3893. Finding the Amount of Property Taxes Paid.

The Town of Occoquan real estate tax rate for fiscal year 2020 is 012 per 100 of assessed value. Access to Other Accounts. Learn all about Prince William County real estate tax.

Prince William County Property Tax Payments Annual Prince William County Virginia. There are several convenient ways to. Press 2 for Real Estate Tax.

Prince William County Tax Administration Division PO Box 2467 Woodbridge VA 22195-2467. You can pay a bill without logging in using this screen. This estimation determines how much youll pay.

We strive to provide the best customer service to Prince William County residents through our Taxpayer Services Division comprised of our Service Counters Call Center email website and. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. Manage Access - Grant Revoke.

The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct. Certain types of Tax Records are available to the. As a resident of the Town you are required to pay both Occoquan and Prince William.

Occasionally the billing information on file is incorrect and a real estate tax bill that should have been sent to a. Payment of the Personal. All you need is your tax account number and your checkbook or credit card.

How The Payment Process. Those who waited until the last minute to pay their personal property taxes in Prince William County encountered problems. Payment by e-check is a free service.

Click here pay online. Welcome to Prince William Countys Taxpayer Portal. At 930 pm the county announced its online.

1-888-272-9829 enter code 1036. The County bills and collects tax payments directly from these companies. Search 703 792-6000 TTY.

In Prince William County. Correspondence and Tax Payments. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

The Passport To Prince William Va Local Deals Offers

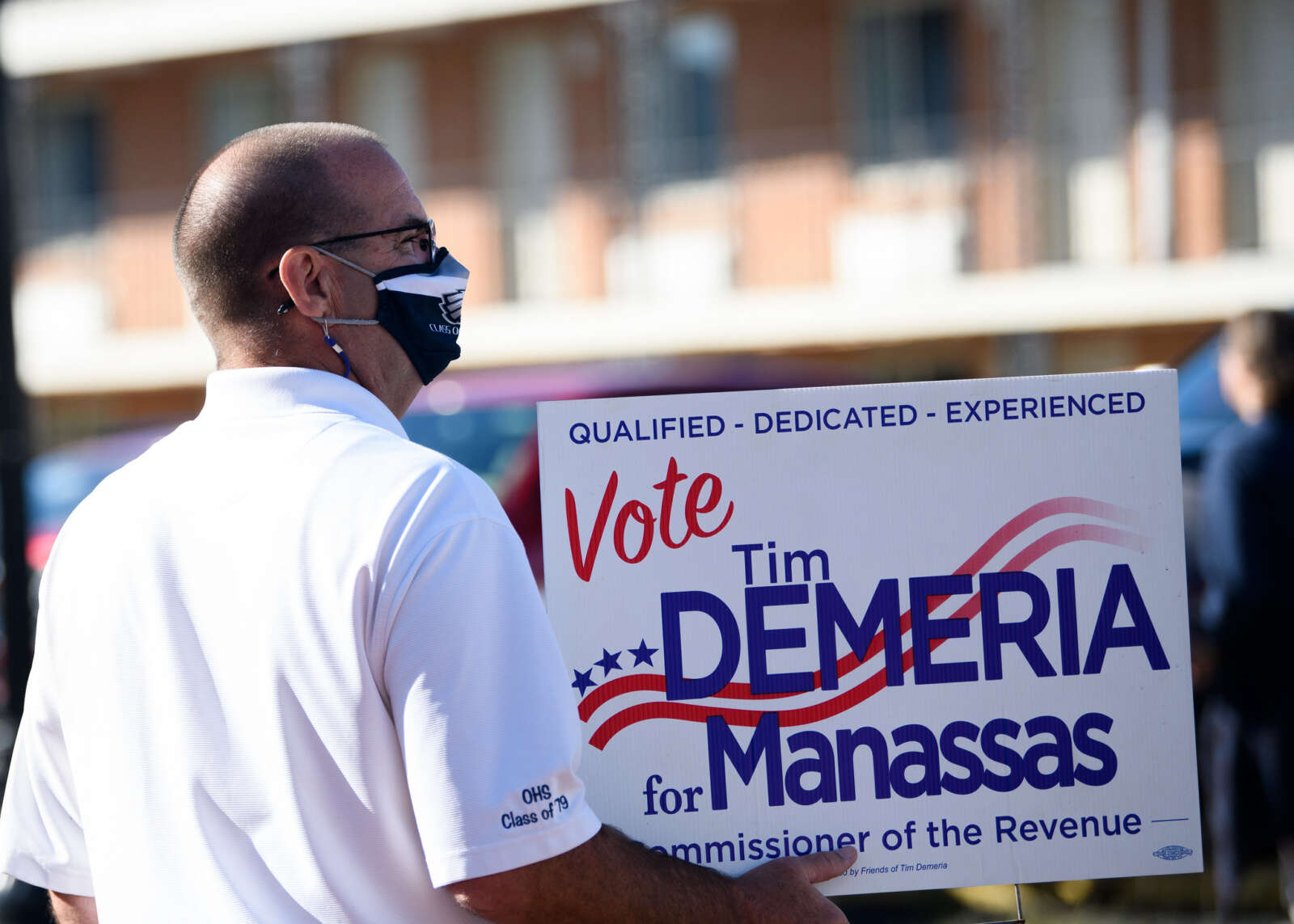

Manassas To Refund Some Personal Property Taxes Send New Bills

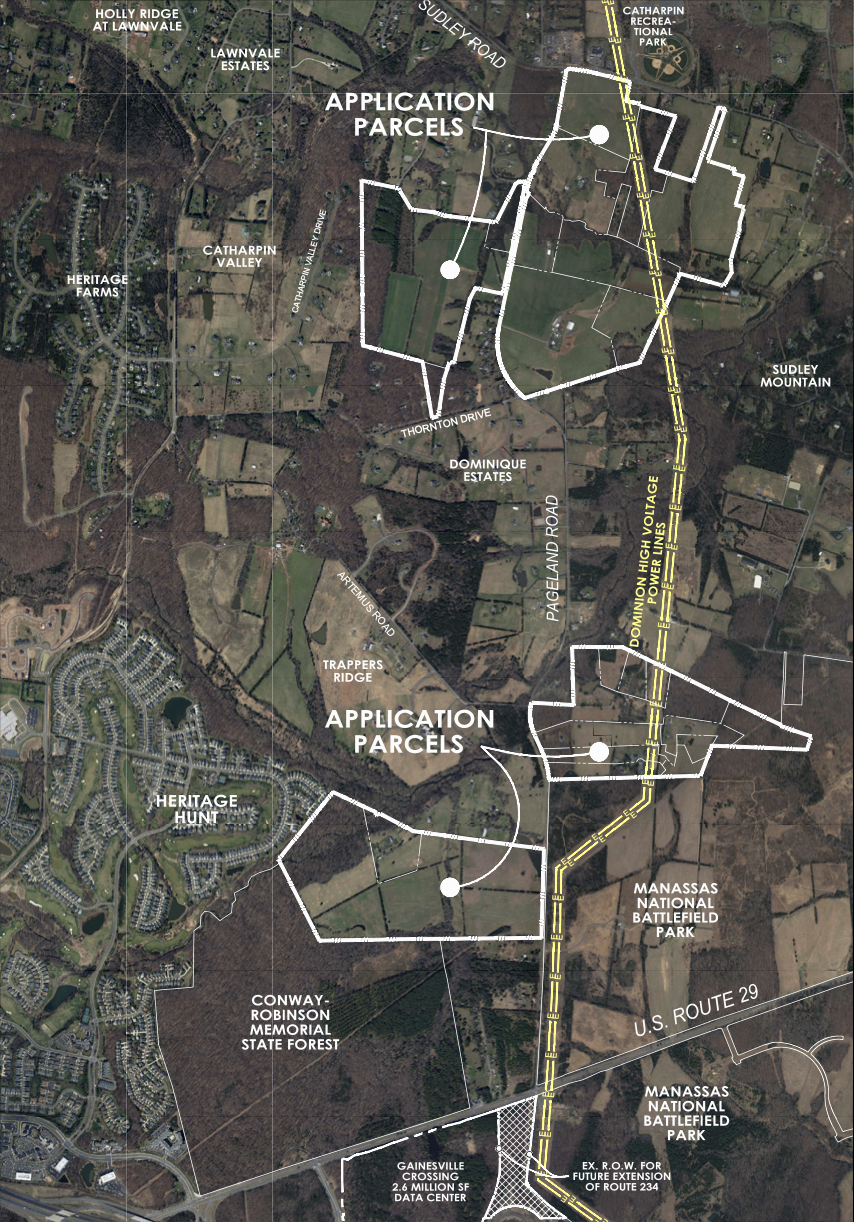

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

A Dozen Western Prince William Landowners Pitch 800 Acre Digital Gateway Near Battlefield News Princewilliamtimes Com

Washington Commanders Move To Buy Woodbridge Site For New 3 Billion Stadium Complex News Princewilliamtimes Com

Prince William County Taxes Likely To Go Up Again Headlines Insidenova Com

Less Taxes Less Spending Prince William Residents Decry Proposed Hike In Tax Bills Headlines Insidenova Com

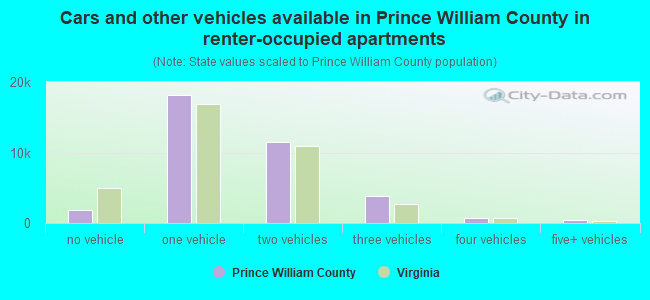

Prince William County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Prince William County Pledges New Protections For Old Cemeteries News Fauquier Com

The Sheriff Of Nottingham In Prince William County

Manassas Residents Fuming Over Tax Bills Revenue Commissioner Stonewalls Press Potomac Local News

Prince William County Va Businesses For Sale Bizbuysell

How Much Nova Property Taxes Differ From Rest Of State Burke Va Patch

Prince William County Va Businesses For Sale Bizbuysell

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

What Are The Tax Implications Of Selling A Rental Property Northern Virginia Property Managementnorthern Virginia Property Management

Prince William Could Steal Loudoun S Title Of Data Center Alley But Land Use Battles Are Raging Virginia Mercury